Get the free return information

Get, Create, Make and Sign irs audit tax form

Editing return letter online

How to fill out irs submit form

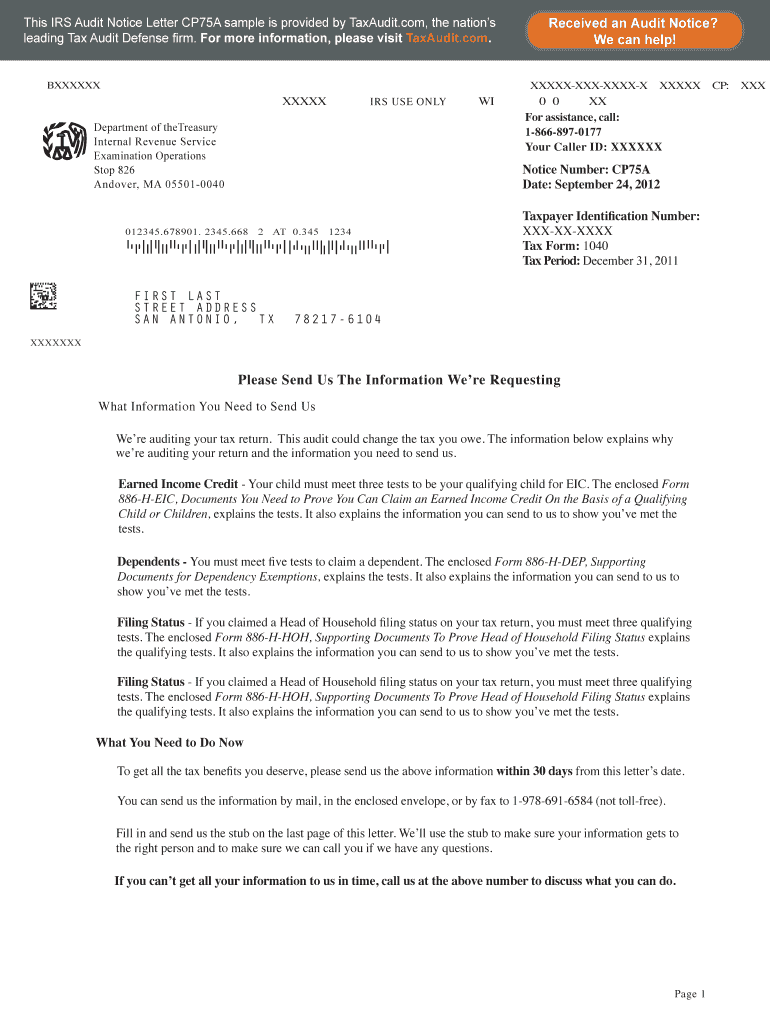

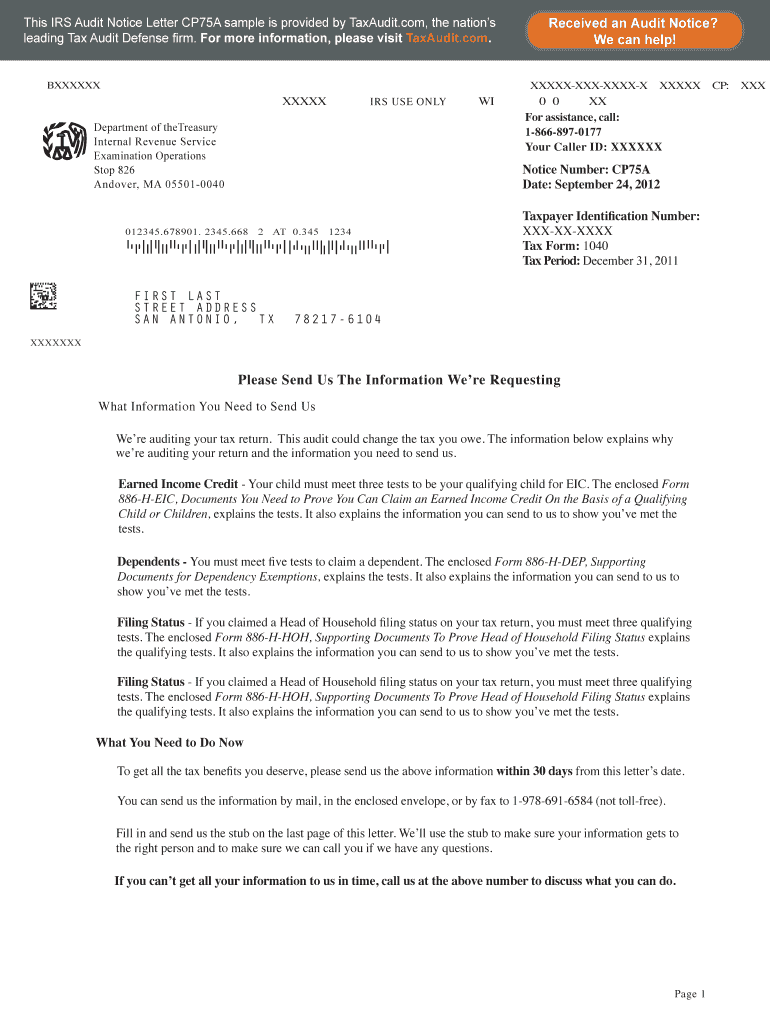

How to fill out Texaudit IRS Audit Letter CP75A

Who needs Texaudit IRS Audit Letter CP75A?

Video instructions and help with filling out and completing return information

Instructions and Help about irs information letter

If you receive ACP 75 a notice from the IRS is saying you were banned from claiming they earn income credit in a prior tax year due to your intentional disregard of the rules or fraudulent claim since your ban is still in effect they are disallowing your use of the Earned Income Tax Credit for the current tax year if you receive a C P 75 C notice from the IRS this is the IRS saying they're auditing your tax return, and they need documentation to verify the income and withholding you reported on your tax return this may affect your eligibility for the Earned Income Tax Credit and your dependent exemptions and other refundable credits that you may have claimed if you receive the CP 75 D notice that is the IRS flat-out saying they are holding your refund pending the results of an audit

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my cp75a directly from Gmail?

How can I get cp75a form?

How do I complete information letter on an iOS device?

What is Texaudit IRS Audit Letter CP75A?

Who is required to file Texaudit IRS Audit Letter CP75A?

How to fill out Texaudit IRS Audit Letter CP75A?

What is the purpose of Texaudit IRS Audit Letter CP75A?

What information must be reported on Texaudit IRS Audit Letter CP75A?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.